ASX posts biggest gain since 2020 as Australian shares follow Wall Street rally on Trump tariff pause

Shares have suffered heavy falls to end the trading week in Australia amid ongoing concerns about inflation, interest rates and the potential impact of looming Donald Trump tariffs. (AAP: Steven Saphore)

Australian stocks increased in value by almost $120 billion, as the local sharemarket posted its best one-day gain since 2020.

The benchmark ASX 200 index surged 4.5 per cent to 7,710 points, while the broader All Ordinaries index jumped 4.7 per cent to 7,914 points.

However, the ASX 200 index remains 1.7 per cent down in April and 5.5 per cent lower so far this year.

The local gains came on the back of even more dramatic rises on Wall Street, where the benchmark S&P 500 index posted its best one-day gain since October 2008 with a 9.5 per cent rise.

That previous higher one-day gain came during the middle of the global financial crisis, and was followed by further steep falls on Wall Street before it finally hit a low in March 2009.

None of the top 200 stocks on the Australian market were lower, with the best gains split between industrial, mining, energy and technology firms.

Zip's 20.7 per cent rise to $1.46 was the best among the top 200 stocks, with Mineral Resources up 18.1 per cent, and uranium miners Boss Energy and Paladin Energy up 17.5 and 17.4 per cent respectively.

Among the market's truly heavyweight stocks, BHP was 5.4 per cent higher at $36, Rio Tinto up 6.4 per cent to $110.59, the major banks from 3.5 per cent for ANZ up to 4.9 per cent for Westpac, but more defensive stocks such as Telstra (+1.4 per cent), Woolworths (+1.1 per cent) and Coles (+1 per cent) had smaller gains.

Well ahead of trading opening on Wall Street later tonight, US futures markets were pricing in a modest decline around 0.6 per cent for the S&P 500.

'US has gone completely off-script'

However, market analysts are generally warning that investors should expect more extreme volatility until the tariff situation is finally resolved.

"Trying to predict the next minute in this market is nearly impossible. The US has gone completely off-script, wrote Swissquote Bank's Ipek Ozkardeskaya shortly before the European market open.

"Donald Trump will go down in history as the most unpredictable US president at best — and at worst, as the one who dismantled the very idea of American exceptionalism.

"Uncertainties will persist, though yesterday's rebound rests on solid ground. We could see it extend — if Trump can just stay quiet for a few days, let the market digest the news, and watch how companies react."

Investors will also be wary of the bond market, where US Treasuries have experienced unprecedented swings, according to Westpac's head of financial market strategy Martin Whetton.

"Every time we've seen a risk off event, where equities fall, where the currency falls, where there's general dysfunctional markets, there is a clear, unequivocal scramble for US dollars. That didn't happen," he said of trading earlier this week that saw US bond prices fall and yields spike to around 4.5 per cent on 10-year bonds.

"Never seen this happen before. So that to me, and that to financial markets professionals who observe these things, I think we were all stunned."

The Australian dollar joined in today's "risk-on" rally, climbing 0.6 per cent to 61.88 US cents during the Asian session.

You can catch up on how the trading day unfolded in our live blog coverage below, complete with more financial news and expert analysis.

Disclaimer: this blog is not intended as investment advice.

Live updates

Market snapshot

- ASX 200: +4.5% to 7,710 points (live updates below)

- Australian dollar: +0.7% to 61.94 US cents

- Nikkei: +8.7% to 34,462 points

- Hang Seng: +2.8% to 20,842 points

- S&P 500: +9.5% to 5,456 points

- Nasdaq: +12.2% at 17,124 points

- FTSE: -2.9% to 7,679 points

- EuroStoxx: -3.5% to 469 points

- Spot gold: +1.3% to $US3,122/ounce

- Brent crude: -0.6% to $US65.07/barrel

- Iron ore: +2.2% to $US99.40/ tonne

- Bitcoin: -1.2% to $US82,02

Prices current at 04:20pm AEST

Live updates on the major ASX indices:

US futures down around 0.5 per cent as we sign off

The US share market looks set for some modest losses after last night's historic rally.

The S&P 500 futures are down around 0.5% at 5:05pm AEST.

But hey, there's quite a few hours until Wall Street starts trading, so anything can happen, right?

Better keep a close eye on Truth Social, I guess!

LoadingJapanese auto industry reacts to Trump tariffs

Reporting by North Asia Correspondent James Oaten

Japan is littered with manufacturing hubs that rely on the auto industry.

One business is iSmart Technologies, which employs over 400 people at several locations.

It makes engines, transmissions, car bodies, and suspension. For the employees, the fact their product is used worldwide is a source of pride.

“I’m really glad the parts we are making are being used around the world in Toyota cars, like the Land Cruiser,” line manager Michiyoshi Kawakami said.

Around 20 per cent of sales here are linked to the US market.

So, President Trump’s 25 per cent tariffs on auto imports is a concern.

The C-E-O of iSmart Technologies, Tetsuya Kimura, says he’s prepared for the fallout, but worries about other business. “I want President Trump to behave more normally,” he told the ABC.

“I understand America First, but eventually it won’t do anything good for America.”

Japan’s chief cabinet secretary says negotiations with the US President have begun, including getting the car tariffs removed.

“We have explained our concerns at various levels and have requested a review of the measures,” he told reporters. A trade envoy is reportedly being deployed this month.

'The US has gone completely off-script'

With our market now shut, and as European traders fire up their computers, Ipek Ozkardeskaya from Swissquote Bank has fired off her daily note.

She observes that European stock futures are generally up more than 8% ahead of the opens there.

But she also warns that the volatility is likely to continue for at least the next 90 days as trade negotiations continue before the tariff pause ends.

"Trying to predict the next minute in this market is nearly impossible. The US has gone completely off-script.

"Donald Trump will go down in history as the most unpredictable US president at best—and at worst, as the one who dismantled the very idea of American exceptionalism.

"Uncertainties will persist, though yesterday's rebound rests on solid ground. We could see it extend—if Trump can just stay quiet for a few days, let the market digest the news, and watch how companies react."

The same may, or may not, be true for China. It's basically a balancing act between its existing economic weaknesses and a government with the power to take almost instant action to try and boost the economy.

"As for China — it's complicated. The 90-day reprieve doesn't apply.

"Inflation data shows deflationary pressures persist despite Beijing's stimulus efforts. But that weakness might just be the fuel needed for stronger support measures.

"For those betting that US exceptionalism is fading, China remains an intriguing — though risky — diversification play."

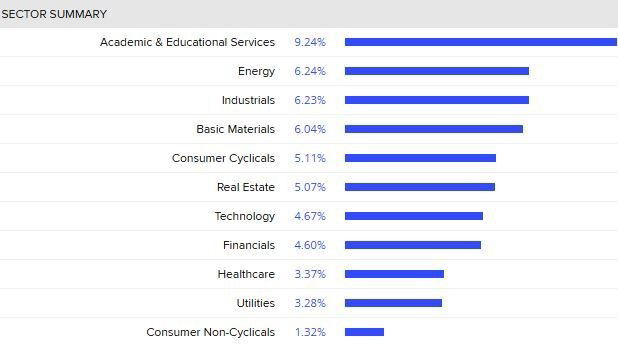

ASX ends 4.5pc higher

The Australian share market has had its best trading day since 2020.

The ASX 200 gained 334 points or 4.5% to 7,710, with all sectors ending higher.

Nearly all 200 shares on the benchmark gained.

Here are the top movers of the day.

'We sincerely apologise': Virgin to refund 61,000 overcharged customers

Earlier today, Virgin Australia came clean about overcharging 61,000 customers over a five-year period.

Initially, Virgin Australia would not reveal the total amount owed to those caught up in the pricing system error but later clarified it owed customers $3.4 million.

But they said the average refund per customer is $55.

"We sincerely apologise to those affected guests and have launched an Itinerary Change Claim Program under which all eligible guests are being proactively contacted to process their refunds," a Virgin spokesperson said.

Read more from ABC business reporter Rhiana Whitson here:

World stocks soar in relief rally

Global shares surged and a manic bond sell-off stabilised on Thursday after US President Donald Trump said he would temporarily lower the hefty duties he had just imposed on dozens of countries.

However, the sharp overnight rally in US stocks and the dollar lost steam as a trade war between the United States and China ratcheted up, with investors also perplexed over the flip-flopping of the Trump administration's tariff plans.

Following a days-long market rout that erased trillions of dollars from global stocks and jolted US Treasury bonds and the dollar, Trump on Wednesday announced a 90-day pause on many of his new tariffs in a shock reversal.

That pushed European futures up sharply in the Asian session, with EUROSTOXX 50 futures and DAX futures climbing nearly 8% each, while FTSE futures gained 5.4%.

Japan's Nikkei similarly advanced more than 8%.

Nasdaq futures fell more than 1% and S&P 500 futures were off 0.8%.

China's CSI300 blue-chip index was up 1%, while Hong Kong's Hang Seng Index advanced 2.4%.

"I guess at least the relief is now global trade won't grind to a complete halt," said Wong Kok Hoong, head of equity sales trading at Maybank.

"The China + 1 supply chain route (is) still intact. As the rest of the world will be at workable 10% tariffs for 90 days, companies/businesses have time/alternatives to adjust supply chain routes."

Still, the onshore yuan fell to its weakest level since December 2007 at 7.3518 per US dollar.

Prior to market opening, the People's Bank of China (PBOC) set the midpoint rate, around which the yuan is allowed to trade in a 2% band, at its lowest level since September 11, 2023.

with Reuters

'Staggering' US bond sell-off unprecedented even in financial crises, says Westpac strategist

Westpac's head of financial market strategy Martin Whetton says we've just witnessed "an epoch change in the political and economic structure of the world".

What he's referring to is a massive sell-off in US government bonds earlier this week, which was particularly unusual because it came at the same time as a sell-off in shares.

"What happened yesterday was, as equity sold off heavily the end of the Tuesday session in the US, the dollar went with it. It shouldn't, it should go up.

"We should buy dollars to say, 'we just want liquidity', they should buy bonds, which means the yield falls.

"What we saw yesterday was about 25-to-30-basis-point rise in US 10-year yields, the cost of government borrowing for the US, 20 minutes in the Asian session."

"Dollar fell, yields went up. They went up at such a rate it was, it was absolutely staggering."

Speaking to Emilia Terzon for The Business, Mr Whetton said the other disturbing thing this week was that the gap between the 10-year government bond rate and the 10-year bank swap rate surged to record highs of up to 60 basis points.

"Never been near that before, not in any financial crisis that I've ever seen," he said.

"20 basis points of which happened in the Asian session — single biggest one-day move in five years.

"So a huge lack of faith in US government debt and saw them sell off. Just haven't seen that happen before."

Mr Whetton says the concurrent sell-off in shares, US bonds and the US dollar is unprecedented in his memory — and he has been working in financial markets for more than two decades, so he was there during the global financial crisis of 2008.

"Every time we've seen a risk off event, where equities fall, where the currency falls, where there's general dysfunctional markets, there is a clear, unequivocal scramble for US dollars. That didn't happen," he said.

"Never seen this happen before. So that to me, and that to financial markets professionals who observe these things, I think we were all stunned.

"And what that says is that people didn't want dollars to finance assets. They're probably choosing other currencies or they're not buying dollar assets to fund."

You can see more of Martin Whetton's comments on The Business tonight at 8:44pm AEST on ABC News Channel or anytime once the program goes up on iView around 7:00pm AEST.

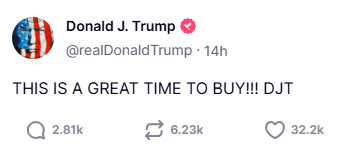

Trump's time to buy post 'doesn't sit well with many'

Just hours before the US president announce his u-turn of tariffs, he was taking to his Truth Social platform, urging people to "be cool" — plus offering some more specific advice:

(DJT being the stock market ticker code of Trump Media & Technology Group.)

Later the same day, US stocks rocketed off their lows on the news of the tariff pause.

The Business has spoken with Westpac's head of financial markets strategy Martin Whetton, who understandably trod carefully on the topic.

"I can understand why people feel shocked by a comment ahead of time to buy stocks.

"It's unusual for a leader to say something like that. His prerogative.

"It doesn't sit well with many people, and it wouldn't be the right way to do things, but that's the way he's chosen to do things."

There's an overwhelming sentiment coming through in our comment section that this is something readers have been thinking about all morning:

Robert: Is this pause further evidence that Trump is playing the markets?

TM: If one was cynical, this might be interpreted as manipulating the market. The 90 day pause would naturally cause the stock market to go into a flurry. Who was in control of the 90 day pause?

Dean Baxter: What’s this? Just market manipulation all along?.. Bargain hunters from yesterday are now 9% up … Are they not?

Steve: Would it be overly cynical or conspiratorial to ask if this whole tariff flip-flop may be part of the biggest insider trading/market manipulation for profit in history?

The Brad: Sounds to me that people are now making themselves richer despite the fact that every country still has a tariff charges, just a bit less. We will all pay for this. We are truly lost if this is how the world works.

How is China responding to the US boosting tariffs to 125pc?

So how has Beijing responded to Trump boosting tariffs on Chinese goods to 125 per cent?

The ABC's East Asia correspondent Kathleen Calderwood says we're yet to see a "really strong response".

Loading...Japan's Toyota City says 25pc auto tariffs are still 'big trouble'

While the US president may have announced a tariff reprieve for most countries, a hefty 25 per cent tax remains on car imports.

No country will feel the pain as much as Japan, which sends one in five cars to the US market.

Trump's taxes could cost Japan $17bn, according to the International Trade Centre.

Making cars is also part of Japanese culture, a beacon of its industrial might.

And few places exemplify this better than Toyota City.

“We changed the name of the city to Toyota in 1959,” said the mayor, Toshihiko Ohta.

“It was the beginning of the motorisation of Japan.”

Just over three quarters of all jobs in Toyota City are linked to the auto sector.

While workers there aren’t hitting the panic button yet, there is a sense that the longer the tariffs remain, the more obvious the pain will become.

“It’s big trouble,” said Shotaro Ido, who works for a car parts company.

“We might lose [our] job. Not in the near future, but maybe a few months or a few years later.”

Japan is sending a top tariff envoy to the US after Prime Minister Shigeru Ishiba spoke to President Trump.

“There is really no information. So, we will just keep a close eye on it,” said Toshihiko Ohta.

Property stocks jump most since March 2020

Real estate stocks jump as much as 5.1% to 3,502 points, marking the biggest intraday jump since the onset of the COVID pandemic.

The sector moving in tandem with Australian benchmark and markets around the world as Donald Trump pauses some of his tariffs, boosting investor sentiment.

DigiCo Infrastructure, which owns and operates data centres, up 17.2%, the top percentage gainer on the sub-index.

The company mirrors Wall Street's overnight rally, which saw Nasdaq Composite closing 12.2% higher.

Another data centre landlord Goodman Group soars as much as 18.8% to $30.98, highest since March 2020.

with Reuters

ASX tracks 4.6pc higher in afternoon trade

The Australian share market is still tracking higher in afternoon trade.

The ASX 200 gained 336 points or 4.6% to 7,711 points, its biggest intraday gain since the onset of the COVID pandemic.

All sectors were higher, with mining, tech and financial sectors leading the gains.

Zip Co, Sandfire and DigiCo were the top performers.

While the benchmark index pared losses from previous trading sessions, it is still down 5.4% so far this year.

Why did Trump backflip on tariffs?

Still questioning Donald Trump's tariff pause?

According to ABC finance reporter David Taylor, it's all because so-called "bond vigilantes" took aim at the US government.

Here's a quick video explainer:

Market snapshot

- ASX 200: +4.6% to 7,717 points (live updates below)

- Australian dollar: +0.3% to 61.70 US cents

- S&P 500: +9.5% to 5,456 points

- Nasdaq: +12.2% at 17,124 points

- FTSE: -2.9% to 7,679 points

- EuroStoxx: -3.5% to 469 points

- Spot gold: +1.5% to $US3,128/ounce

- Brent crude: -1.2% to $US64.67/barrel

- Iron ore: +2.2% to $US99.40/ tonne

- Bitcoin: -1.7% to $US81,748

Prices current at 02:10pm AEST

Live updates on the major ASX indices:

What to expect for equity markets in the weeks ahead?

UBS analysts have published a note after huge falls and leaps on Wall Street in the past few days triggered by US President Donald Trump's tariff policies:

"Market volatility is likely to remain elevated in the weeks ahead as investors assess rapidly shifting tariff developments and consider the potential implications for growth, inflation, central bank policy, and financial markets.

Our base case (50% probability) has been for higher tariffs in the near term, followed by gradual rollbacks as political, business, and legal challenges mount, trading partners offer concessions, and/or as popular support for the Trump administration falls.

Trump’s post on Wednesday opens the door to potential tariff reduction “deals” for many trading partners. We believe this approach from the US administration is consistent with an “escalate to deescalate” strategy toward much of the world.

At the same time, we remain mindful of the greater-than-expected escalation between the US and China, the precise details of the latest US policy shift have yet to be announced, and it is not certain that the proposed pause will hold.

Despite Wednesday’s announcements to lower the reciprocal tariff rate for most countries to 10%, the escalation between the US and China could dramatically impact trade between the world's two largest economies. We currently estimate the overall US effective tariff rate at 27% (versus 9% prior to 2 April). Excluding trade with China, the effective tariff rate is 11%.

In our base case, we expect tariff moderation and Fed rate cuts to support a rebound in the S&P 500 to 5,800 by year-end, despite slowing US growth. We see the 10-year Treasury yield declining to 4.0%.

In an upside scenario (20% probability), equity markets continue to rebound sharply amid a more permanent resolution of trade disputes, the avoidance of a material slowdown in growth, and optimism about the impact of AI on earnings. In this scenario, the S&P 500 ends the year around 6,500.

In a downside scenario (“hard landing”; 30% probability), the “pause” in tariffs ultimately does not hold and tit-for-tat retaliation resumes. Weak demand leads to a severe US recession. S&P 500 levels in the 3,500-4,500 range would be consistent with historical recessions. We believe the 10-year Treasury yield would drop to 2.5% in this scenario."

Smaller Asian markets continue to rally

Some of Asia's smaller markets are rallying in the wake of Trump's 90-day tariff pause announcement.

Vietnam stocks soared more than 6.5 per cent on Thursday after Washington delayed its 46 per cent tariff on exports from the country.

The main index was up by 72.41 points, or 6.62 per cent, to 1,166.71 points shortly after opening.

Indonesia's benchmark stock index rallied nearly 5 per cent higher after the announcement.

The Jakarta Composite Index was up 289.2 points, or 4.85 per cent, to 6,257.18 shortly after markets opened on Thursday.

It comes two days after stocks tanked more than 7 per cent, in their biggest drop since 2011.

Meanwhile Thai stocks have opened 4.5 per cent higher.

with AFP

Donald Trump met his match. It's called the bond market

What was behind Donald Trump's about-face, with the pause on his so-called 'reciprocal' tariffs, outside of China?

Chief business correspondent Ian Verrender has given us his take — writing that the US president met his match in the bond market:

Overnight, he was confronted by a force far greater than his own and the office he now holds.

The US president ran headlong into a brick wall of opposition and had no option but to back down.

It's called the bond market — an arena where brutality knows no bounds and where the participants take no prisoners…

For weeks, he has shrugged aside an unrelenting fall on Wall Street as stocks dived on the prospect of lower growth, a spike in inflation and the growing chance of a recession.

But on Tuesday, after weeks of discontent, the real power players on financial markets took action.

In an unprecedented attack on America's global financial dominance, they began abandoning US government bonds, sending market interest rates sharply higher.

More than a mere rebuke, it was an ominous sign that the world was losing faith in America and that the US would pay the price.

Read the full analysis here:

Australia's biggest stocks on the rise

As you'd expect with such a strong rally, some of our biggest listed companies are doing some heavy lifting.

Here's a check in on some of the major players:

- James Hardie +10.8%

- Goodman Group +7.7%

- Woodside +6.9%

- Macquarie +6.6%

- QBE +6.2%

Miners are doing well (BHP +5.8%, Rio Tinto +5.9%, Fortescue +5.9) as are the major banks (CBA +3.2%, ANZ +3.4%, NAB +4.8%, Westpac +4.9%)

Coles is the only stock amongst the top 20 right on the flatline. Woolworths is up 1%.

Virgin Australia admits to overcharging customers at least $3.3m

Virgin Australia's come clean about overcharging 61,000 customers between April 2020 and March 2025.

Customers were overcharged when changes were made to their itineraries, according to a spokesperson from Virgin Australia.

Initially, Virgin would not reveal the total amount owed to affected customers, but later clarified the figure was $3.4 million.

The average refund per customer is $55, a spokesperson says.

Are you one of them? Turns out I am. I received an email from the airline this morning which says I am owed $50.

"Some bookings were repriced in a way that does not align with our policy and, we are refunding all impacted guests for that amount," the spokesperson said.

"We sincerely apologise to those affected guests and have launched an Itinerary Change Claim Program under which all eligible guests are being proactively contacted to process their refunds."

The airline has appointed Deloitte to manage the claims process, which will be open for 12 months.

Unclaimed amounts will be donated to a charity, the airline says.

"A dedicated Virgin Australia team has also been working to fix the issue and we have undertaken a range of actions to prevent this from reoccurring in the future, so our guests can be confident when making changes to their bookings," a spokesman said.

The airline says it has notified the ACCC about the "error" and will work with the regulator on any additional actions necessary.

You can access the online claim portal run by Deloitte here.