Geopols & US fiscal updates in focus, DXY continues to falter - Newsquawk Europe Market Open

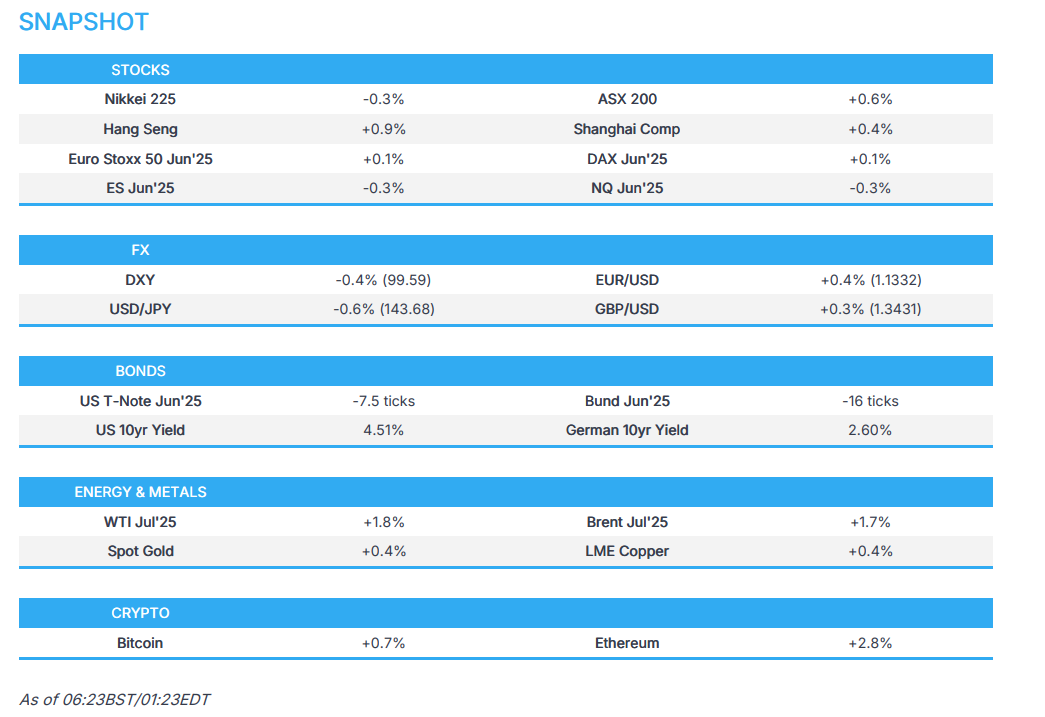

- APAC stocks traded with a mild positive bias as the region mostly shrugged off the lacklustre lead from Wall St.

- US House Speaker Johnson said a Thursday tax bill floor vote is still realistic.

- European equity futures indicate a quiet cash market open with Euro Stoxx 50 future flat after the cash market closed with gains of 0.5% on Tuesday.

- DXY is extending its losing streak for a third session, EUR/USD is back above 1.13, Cable sits above 1.34 ahead of UK CPI.

- Israel is preparing a possible strike on Iranian nuclear facilities, according to CNN; not clear whether Israeli leaders have made a final decision.

- Looking ahead, highlights include UK CPI, G7 Central Bank and Finance Ministers Meeting, ECB's Lagarde, Lane, Nagel & Cipollone, Fed's Barkin & Bowman, Supply from UK, Germany & US.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were choppy and ultimately closed mostly lower to snap a six-day win streak on Wall St, with the majority of sectors in the red while defensives outperformed. As there was a lack of US data, the focus was on US President Trump's tax bill talks in which he attempted to get Republicans on board with his tax bill, but it appears there is more work to do and House Freedom Caucus Chair suggested they would eventually get there albeit with uncertainty regarding the timing. Furthermore, there weren't any major trade-related developments, although reports noted that Japan is mulling accepting a US tariff reduction instead of an exemption and that its top negotiator will visit the US for a third round of discussions this Friday.

- SPX -0.39% at 5,940, NDX -0.37% at 21,367, DJI -0.27% at 42,677, RUT +0.05% at 2,106.

- Click here for a detailed summary.

TARIFFS/TRADE

- China’s Commerce Ministry said US measures on China's advanced chips are typical of unilateral bullying and protectionism, while it added that US chip measures seriously undermine the stability of the global semiconductor industry chain and supply chain. MOFCOM also stated that the US abuses export controls to contain and suppress China, violating international law and basic norms. Furthermore, it said China urges the US to immediately correct its erroneous practices and to abide by international economic and trade rules and respect other countries' rights to scientific and technological development.

- Japan’s Economy Minister Akazawa, who is the country’s top tariff negotiator, is to visit the US for the third time on Friday and a fourth visit to the US this month is also a possibility, according to Nikkei.

- FBN's Gasparino posted that the state of the tariff talks between the US and Japan provides a window into just how difficult constructing even trade frameworks has become with Japan now posturing by demanding US concessions as talks are set to begin, while both sides still need to position on specific issues, according to sources. Furthermore, the US is also demanding more so-called burden sharing from Japan on paying for the US military in the country and region.

NOTABLE HEADLINES

- Fed's Musalem (2025 Voter) said monetary policy is currently well-positioned, while a balanced response to higher inflation and unemployment is feasible if inflation expectations stay anchored. Musalem stated that if inflation expectations become de-anchored, the Fed policy should prioritise price stability and noted that the US economy has underlying strength, the labour market is stable and inflation has eased but is above the 2% goal.

- Fed's Hammack (2026 voter) gave three scenarios on tariffs, as the traditional approach to projecting the economy with a baseline scenario may not be the best way to think of the outlook right now. Hammack said the first scenario is that tariffs have a one-off price effect, but economic growth takes a hit from policy uncertainty, while the second scenario is that the labor market holds up, but tariffs are inflationary, and the third is a stagflationary outcome where the economy slows alongside higher inflation which she sees as most likely. Fed's Hammack separately commented that sentiment data about the economy has been concerning and if the Fed is challenged on inflation and unemployment, it would be a difficult choice. Furthermore, she said it will take more time to see how business decisions are influenced by trade policy and the current best action for the Fed is to sit on its hands.

- Fed's Bostic (2027 voter) said further instability in the Treasury market would add to uncertainty and noted the current US tariff level is better than it was as initially proposed, but still high enough that it is difficult to assess what will happen. Bostic added the Fed needs to be more certain about the outlook to be comfortable about how monetary policy should shift.

- Fed's Daly (2027 voter) said the net effect of Trump administration trade, immigration and other policies remains unknown.

- US President Trump said the Golden Dome defence shield will include space-based interceptors and should be operational by the end of his term, while he added that Canada said they want to be part of it and said the total cost is about USD 175bln.

- US President Trump posted on Truth the US must maintain their worldwide leader status in WiFi, 5G and 6G and he is going to free up plenty of spectrum for auction, while he added "Congress must put 600 MHz in “THE ONE, BIG, BEAUTIFUL BILL”.

- US House Speaker Johnson said they will complete SALT discussions on Tuesday night and are very near a final agreement on IRA energy credits, while he added that a Thursday tax bill floor vote is still realistic. It was later reported that a group of blue-state Republicans and GOP leaders reached a tentative deal for a USD 40,000 SALT deduction, according to POLITICO.

- White House Director of the Office of Management and Budget Vought said the Moody's downgrade timing was trying to jeopardise the ability to get the budget bill done, although he thinks the budget bill will pass this week and is optimistic.

APAC TRADE

EQUITIES

- APAC stocks traded with a mild positive bias as the region mostly shrugged off the lacklustre lead from Wall St but with the gains capped in the absence of any major fresh macro drivers and tier-1 data releases.

- ASX 200 was led by strength in utilities and the commodity-related stocks with gold miners lifted by recent gains in the precious metal.

- Nikkei 225 faded its opening gains with headwinds from a firmer currency and after mixed Japanese trade data.

- Hang Seng and Shanghai Comp conformed to the predominantly upbeat mood in the region but with the upside limited in the mainland as frictions lingered after China renewed its criticism against the US for its chip controls and urged the US to immediately correct its erroneous practices.

- US equity futures (ES -0.3%, NQ -0.3%) remained subdued following the uninspired performance on Wall St, where the S&P 500 and Dow snapped their six-day win streaks.

- European equity futures indicate a quiet cash market open with Euro Stoxx 50 future flat after the cash market closed with gains of 0.5% on Tuesday.

FX

- DXY resumed its recent weakening trend and retreated further beneath the 100.00 level amid very few fresh catalysts and a quiet US data calendar, while a recent slew of Fed rhetoric provided very little incrementally and there was also renewed criticism from China's MOFCOM on the US regarding chip controls.

- EUR/USD benefited from the pressure in the dollar and reclaimed the 1.1300 handle, while there is another bout of ECB comments later including from Lagarde after the prior day's slew of rhetoric from the central bank's officials.

- GBP/USD added to its recent spoils after breaching through resistance at 1.3400 and with UK CPI data expected to accelerate.

- USD/JPY retreated beneath the 144.00 level with the pair dragged lower amid the dollar selling and risk aversion in Tokyo.

- Antipodeans mildly edged higher in quiet trade amid the mostly positive risk and recent upside in commodities.

- PBoC set USD/CNY mid-point at 7.1937 vs exp. 7.2133 (Prev. 7.1931).

FIXED INCOME

- 10yr UST futures remained lacklustre after yesterday's choppy performance and mild curve steepening amid the Trump tax bill updates, with demand also constrained overnight ahead of supply.

- Bund futures traded subdued and reapproached the 130.00 level as today's auction for EUR 4bln of Bunds looms.

- 10yr JGB futures quietened down from yesterday's post-auction volatility with little fresh catalysts and after mixed trade data.

COMMODITIES

- Crude futures were underpinned following a CNN report that new intelligence suggested Israel is preparing a possible strike on Iranian nuclear facilities, although it added that it was not clear whether Israeli leaders have made a final decision.

- US Private Inventory Data (bbls): Crude +2.5mln (exp. -1.3mln), Distillates -1.4mln (exp. -1.4mln), Gasoline -3.2mln (exp. -0.5mln), Cushing -0.4mln.

- EU is likely to propose a quota as the mechanism to enforce a bloc-wide import ban on Russian gas by the end of 2027, which officials say should provide companies with a legal basis to terminate long-term purchase contracts, according to Bloomberg.

- Spot gold was kept afloat by dollar weakness and amid the ongoing backdrop of trade and geopolitical uncertainty.

- Copper futures extended on the prior day's intraday rebound after gaining on a softer dollar and as Asian bourses mostly shrugged off the weak handover from US peers.

CRYPTO

- Bitcoin was choppy and briefly tested the USD 107,000 level to the upside before returning to flat territory.

NOTABLE ASIA-PAC HEADLINES

- South Korea's government will prepare support measures for the biopharmaceutical sector and will prepare additional measures for the auto industry if needed.

DATA RECAP

- Japanese Trade Balance (JPY)(Apr) -115.8B vs. Exp. 227.1B (Prev. 559.4B)

- Japanese Exports YY (Apr) 2.0% vs. Exp. 2.0% (Prev. 4.0%)

- Japanese Imports YY (Apr) -2.2% vs. Exp. -4.5% (Prev. 1.8%)

GEOPOLITICS

MIDDLE EAST

- New intelligence suggested that Israel is preparing a possible strike on Iranian nuclear facilities, according to US officials cited by CNN although the report added it was not clear whether Israeli leaders have made a final decision.

- Israeli PM Netanyahu ordered the return of the delegation from Qatar, but a small team to remain to continue talks.

- Israeli military head said Israel will expand manoeuvres in Gaza and capture additional territory, according to Reuters.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said he welcomed new British and EU sanctions on Russia and said it 'would be good if the US also helped'.

- Ukraine's Finance Minister Marchenko said G7 ministers will discuss all necessary and critical issues related to Ukraine's reconstruction, while he will reiterate the need for stronger sanctions on Russia.

- US Secretary of State Rubio said the US will impose new sanctions on Russia if there is no progress on a peace deal.

- US President Trump said he is not worried about reports of a Russian military buildup along Finland.

EU/UK

NOTABLE HEADLINES

- UK Deputy PM Rayner sent a secret memo to UK Chancellor Reeves, pushing for a new tax raid on savers, according to The Telegraph. The memo proposed eight tax increases including reinstating the pensions lifetime allowance and changing dividend taxes.