Accounting Financial Reporting in New York, USA Faces Major Transformation with New Accounting Reforms

Outsourcing accounting services in New York helps businesses navigate complex regulations, ensure compliance, and drive growth.

Maximize accuracy & compliance—outsource your accounting now! Click here

Moreover, as businesses navigate evolving demands, the increasing reliance on outsourced accounting firms mirrors broader industry trends. Companies are finding that these external partners provide compliance support as well as strategic financial guidance. In a city known for its stringent regulations and fast-paced economy, businesses are turning to agile solutions that ensure timely reporting, tax efficiency, and risk mitigation. As a result, outsourced firms are becoming long-term partners, playing an essential role in driving business success.

"Accounting financial reporting in New York is being reshaped by new reforms, ensuring greater transparency and compliance," said Ajay Mehta, CEO of IBN Technologies. "Businesses must adapt to these changes to maintain financial integrity and remain competitive."

Perhaps most importantly, in response to growing demands, outsourced accounting firms are increasingly focused on providing customized solutions that align with the specific needs of various business models and industries. Companies looking to outsource their accounting functions are prioritizing firms that offer seamless integration with existing financial systems, maintain robust data security protocols, and stay up to date with federal, state, and local regulations. Additionally, businesses in sectors such as real estate, healthcare, and fintech are seeking financial accounting professionals with industry-specific expertise to ensure compliance with financial reporting standards unique to their fields. This trend is further underscored by the need for specialized services that address the complexities of different industries, ensuring businesses can meet their financial goals with precision and confidence.

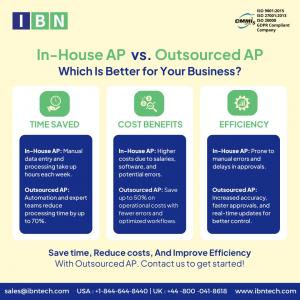

As a result, this shift has had a significant impact on small businesses, many of which face challenges in managing financial operations while remaining competitive. Outsourcing has emerged as a practical solution, enabling entrepreneurs to focus on growth rather than dealing with complex tax codes and financial statements. With the cost savings of eliminating full-time accounting staff and access to high-level financial expertise, businesses can also ensure compliance, reducing the risk of audits, penalties, and reporting errors.

"As accounting financial reporting standards evolve, companies must stay ahead of the curve," said Ajay Mehta, CEO of IBN Technologies. "These reforms will enhance accuracy in financial reporting, fostering trust and growth in New York's business sector."

For businesses in New York, outsourced accounting services are reshaping operations by integrating advanced financial technologies. Cloud-based platforms now enable real-time access to financial data, facilitating seamless remote collaboration between businesses and their accounting teams. Automation tools streamline bookkeeping tasks, minimizing manual errors, and boosting overall efficiency. Meanwhile, artificial intelligence is being leveraged for predictive financial analysis, empowering businesses to make data-driven decisions. Additionally, cloud technology is gaining momentum for its ability to provide secure, transparent financial transactions, helping mitigate fraud risks.

Get expert bookkeeping—claim your free 30-min consultation now!

https://www.ibntech.com/free-consultation/?pr=EIN

In response to the growing cybersecurity threats, financial service providers are strengthening their security measures to protect sensitive financial data. Encryption, multi-factor authentication, and regulatory compliance frameworks are becoming standard practices, ensuring businesses can rely on secure and efficient outsourced financial management. The combination of innovative technology solutions and personalized financial guidance has established outsourced accounting firms as crucial partners for businesses navigating an increasingly complex financial landscape.

Optimize costs with transparent pricing—request your custom quote today!

https://www.ibntech.com/pricing/?pr=EIN

New York’s small businesses are rapidly shifting toward outsourced accounting as financial complexity grows and competition intensifies. The push for efficiency, regulatory compliance, and real-time financial insights has made expert-driven solutions essential. Industry leaders are stepping in with AI-powered forecasting, cloud-based accounting platforms, and automated financial management tools. Among them, IBN Technologies has played a key role in equipping businesses with the resources needed to streamline operations and maintain stability in an unpredictable economic climate.

As regulatory demands tighten and business operations become more intricate, companies that fail to modernize risk falling behind. Outsourced financial service providers are helping businesses mitigate risks, enhance decision-making, and ensure long-term growth. IBN Technologies, recognized for its expertise in financial transformation, has been instrumental in helping New York’s small businesses adopt seamless, technology-driven accounting solutions. In a rapidly evolving marketplace, companies embracing these innovations are not just adapting—they are setting the pace for the future of financial management.

Related Services:

1) Catch-up Bookkeeping/ Year End Bookkeeping Services

https://www.ibntech.com/ebook/catch-up-bookkeeping-guide-for-financial-and-tax-success/?pr=EIN

2) AP/AR Management

https://www.ibntech.com/accounts-payable-and-accounts-receivable-services/?pr=EIN

3) Tax Preparation and Support

https://www.ibntech.com/us-uk-tax-preparation-services/?pr=EIN

4) USA Bookkeeping Services

https://www.ibntech.com/bookkeeping-services-usa/?pr=EIN

5)Payroll Processing services

https://www.ibntech.com/payroll-processing/?pr=EIN

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human sources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release